Thank you for choosing LiveDiligence to access and collaborate with your advisor’s due diligence reviews. In this quick start guide we cover the core features that deliver benefits to clients.

Please see our detailed account set-up guide for step by step instructions to set-up your account.

1. LiveDiligence

LiveDiligence is a client-facing platform for structuring, reporting and collaborating on due diligence.

LiveDiligence enables clients to quickly and clearly see:

- what’s important – filter the whole due diligence review for risk level and status. No more hunting through lengthy reports to find the information that matters.

- what’s holding things up – no more flipping between emails, Q&A sheets and report versions. LiveDiligence brings all the information you need to assess risk in one place.

- what’s new – generate your own redline reviews and filter for ‘only changes’ to show just the changes new for you.

Investors and lenders benefit from live access to their risk review, so they can track issues as they develop, avoiding last minute surprises in the run-up to close.

“I wish all our advisors used the LiveDiligence platform!”

Benjamin Kennedy, Director of M&A & Development, Ørsted

“LiveDiligence was excellent, especially the live updates. It is so easy to navigate and a big help with our IC papers. Legal and technical DD in one platform feels game changing."

Baiju Devani, UK Investment Director, Bluefield Partners LLP

More information including client testimonials can be found on our website.

2. Home

The home page provides access to all your transactions as well as quick access to customer support and knowledge base articles. Your library of transactions will build over time as you are invited to more due diligence projects on LiveDiligence.

If you have multiple advisors working on the same deal these will appear as separate transactions. Dip in and out of your advisor’s reviews, or open multiple reviews in separate browser tabs.

Your legal advisor can interact with your technical advisor’s review and vice versa by way of comments and Q&A, once invited to each other’s transactions. You no longer have to be the post box!

3. Risk review

The risk review contains the full due diligence review.

a. Layout

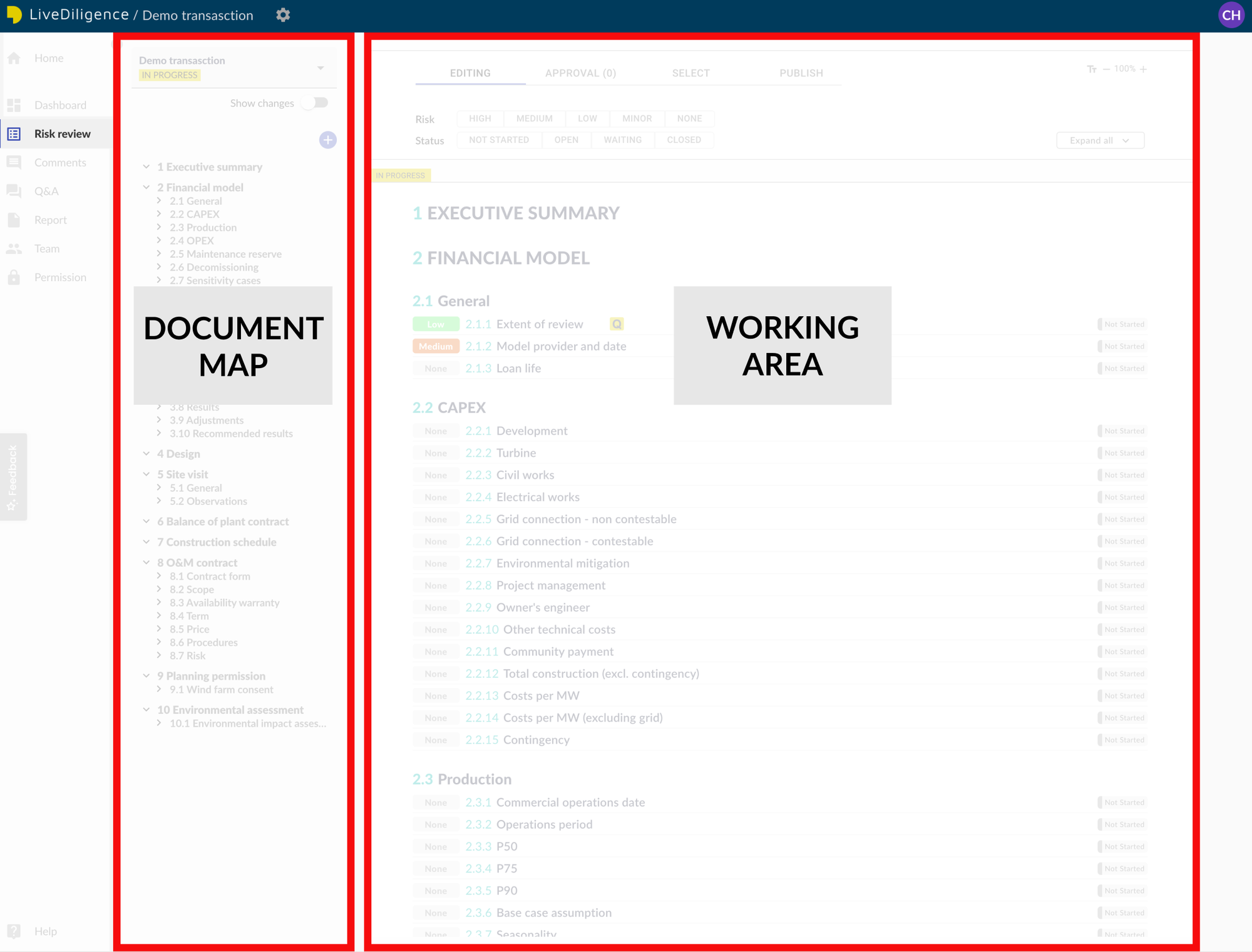

The risk review is split into two sections :

- Document map: for navigation.

- Working area: for viewing all types of content, including risk descriptions, recommendations, risk levels, comments and questions.

b. Structuring content

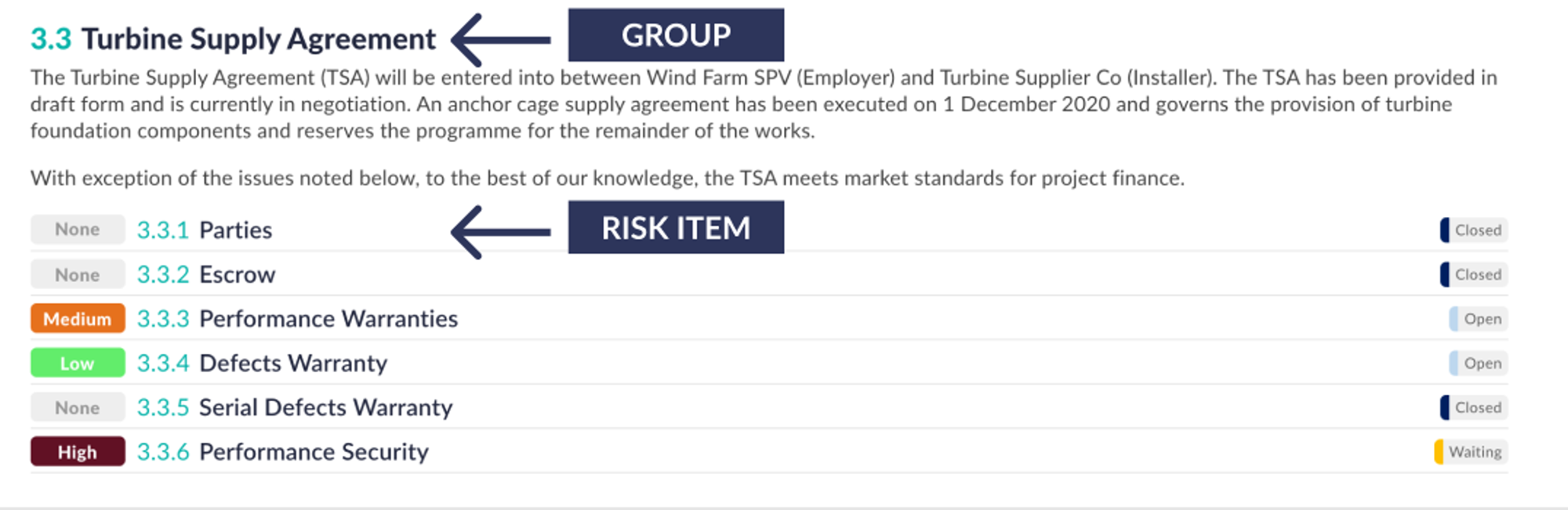

Content on LiveDiligence is organised into risk items and groups:

- Risk items: describe the characteristics of an individual risk

- Groups: organise risk items into topics.

An example of a group could be a Turbine Supply Agreement. An agreement like this contains several elements such as a performance warranty and defects warranty which can be captured as individual risk items.

c. Risk items

Risk items are the fundamental unit of risk assessment within LiveDiligence.

Risk items are designed to capture, in a single place, all the information needed to evaluate an individual risk. This includes the following information:

- Description: A description of the risk, including relevant context, photos, data etc.

- Recommendation: Actions or mitigating measures that may be required to reduce the likelihood or impact of a risk.

- Risk level: Risk classification (none, minor, low, medium, high).

- Status: Degree of progress assessing the risk (not started, open, waiting, closed).

- Comments: External communication related to the specific risk.

- Q&A: Formal Q&A raised in regard to the risk item.

d. Risk and status filters

Instant filters make it easy to identify critical risks or unfinished review elements.

Select the desired risk level and status to filter the entire transaction.

The filtered risk review will comprise risk items that meet the chosen filter settings, plus parent group titles for context and any supporting information in parent group summaries.

Things to try

- Filter to find the risk items with the highest risk levels

- Filter to find all risk items waiting for input

e. Agile due diligence and review publishes

All published iterations of your due diligence review can be accessed from the drop down menu above the risk review document map. The list is sorted by date of publish, with the most recent at the top and selected as default.

LiveDiligence makes it easy for your advisors to publish individual elements of their review as soon as they are ready, rather than wait for complete drafts. Advisors can share early insights from review of an information memorandum, critical contracts or an energy review for example. Advisors can publish updates as frequently as their clients require. This agile approach to due diligence allows for early and ongoing risk mitigation, avoiding the stress of receiving last minute issues in the run-up to closing.

We know that for some users sticking to the standard draft and final report deliverables fits best with their way of working. LiveDiligence makes this easy too, and supports those clients that only want to see the PDF.

LiveDiligence tracks and displays all changes between different published versions - so you always have a mark-up whenever you need it, without having to chase your advisor for a redline. Switch on the “Show changes” toggle to compare any version of the risk review to another to see what’s new. All additions and deletions will be highlighted.

Select “ONLY CHANGES” to show only the review elements that have changed. Clients and advisors both love this feature - no more searching through lengthy reports to find updated content.

You choose the review versions to compare - check for latest changes or find out what’s new since you’ve been on holiday for a few weeks.

Things to try

- Check the drop down menu to see how many due diligence review iterations have been published

- Switch on the “Show changes” toggle to compare published versions and test out the “ONLY CHANGES” view

4. Comments

Comments are the main form of communication within LiveDiligence and can be seen by both clients and advisors. A good way to think of comments is as the LiveDiligence version of marking up a report with comments for your advisor, just much more powerful!

For information, advisors have a separate editor comments feature for internal communication only, that cannot be seen by clients. There is no client only comments functionality at present - please let us know if you would find this helpful.

Comments can be added to any element of the working area, whether a group, or a risk item.

To add a comment, open the add menu and select "Comment". This will open the risk review sidebar where you can type your comment. A comments icon in the working area will indicate that a comment has been raised and whether it has been resolved.

All transaction comments are automatically collated in a separate comments page for easy comments management, including filtering for resolved comments and export to Excel.

Things to try

- Add a new comment for your advisor

- Reply to an existing comment

- @mention one of your advisor team in a comment

- Check for any unresolved client comments

- Export the collated list of comments

5. Q&A

You told us how much time you waste managing Q&A across fragmented systems, juggling Excel spreadsheets and emails – so we built something better.

LiveDiligence Q&A supersedes the traditional Q&A spreadsheet and replaces or compliments 3rd party data room solutions. LiveDiligence Q&A provides:

- Q&A in context with the due diligence review

- Automatic Q&A collation so you never miss a question

- A single source of truth always with the latest Q&A status

- No more Q&A sheet juggling

Advisors can add formal questions to any element of the working area. A Q&A icon in the working area will indicate that a question has been raised (yellow) and whether it has been closed (grey).

Clicking on the Q&A icon will open the sidebar where you can view and respond to the Q&A associated with a specific risk item or group.

Advisors can invite other transaction parties (for example borrowers, sellers and other advisors) to the transaction to respond to questions direct, within LiveDiligence. Access can be restricted to only the Q&A if desired, or expanded to include the due diligence review for context.

All transaction Q&A threads are automatically collated in a separate Q&A page for easy Q&A management, including search and filtering for open/closed, priority, assignment or last activity.

The authoring advisor can quickly export this list to Excel and share via email - we are working to provide this export functionality to other user types.

Advisors can set question assignment and visibility by organisation and flag important questions as high priority.

Transaction parties can respond to questions direct, within LiveDiligence.

Q&A search can be used to find specific Q&A items easily.

Things to try

- Filter the collated Q&A for open or closed questions

- Sort the collated Q&A by any of the headings, e.g. last activity or priority

- Click the question # in the collated Q&A to see the Q&A thread in context, in line with the review

- Respond to a Q&A question

6. PDF report

Your advisors can provide traditional PDF due diligence reports from LiveDiligence at any stage in the review, for example the typical deliverables of draft and final reports at agreed milestones.

LiveDiligence PDF reports are generated from the content of the risk review and meet all usual requirements for due diligence reporting.

Redline PDF reports can also be generated between any published risk review versions.

Collated comments and Q&A can be exported and provided separately by your advisors.

7. Permissions

LiveDiligence uses a role based permissions system for easy and secure user management.

Advisors invite users to their transaction and control role specific transaction access and permissions:

- Risk review access and permissions: Control who can see and edit what, by selecting from the options of Hidden, Read, and Read & write, for all risk review elements. Fine control is possible, with option to set permissions at individual group and risk item level.

- Feature access and permissions: Toggle on and off access to the core platform functionality. There is some in-built feature limitation reflecting chosen user type (internal user, external editor or client).

It is easy for advisors to create roles appropriate for all transaction parties, e.g. borrowers can have access to transaction Q&A but not the due diligence review itself and clients can have access to the full review, comments and Q&A but no review edit rights. Advisors can create custom roles to meet all typical transaction requirements.

8. Support

We hope you will love using LiveDiligence. For help and to share feedback:

- Help: Click on the help button at the top right of the app to open the in-app help sidebar to access customer support and knowledge base articles like this one.

- Feedback: Bugs, typos, feature suggestions - all welcome! Our mission is to deliver a radically better due diligence experience and your feedback is critical to achieving this.

Please use the “Contact Us” button at the bottom of the in-app help sidebar to share your feedback and request support. Alternatively you can email us any time at support@livediligence.com